Medicare Supplements expand the coverage of Original Medicare for millions of Americans. Enrolling clients into Medicare Supplements when they turn 65 isn’t difficult, since those aging into Medicare have the opportunity to sign up for any Medicare Supplement regardless of health. But this isn’t always the case. Sometimes a client will have to pass underwriting, a process where health matters.

Underwriting can be complex to master, with each carrier treating it differently. We’ve discerned trends and compiled information on how roughly two dozen Medicare Supplement companies approach underwriting. We’ll dive deep into why companies perform underwriting, how it works and when it applies, health conditions that will lead to a declined application, health conditions that always have restrictions, health conditions that act as wild cards, and tips to make your life easier.

Understanding the Basics

Medicare Supplement (Med Supp) underwriting may seem intimidating, but learning the what, why, and when of underwriting is the first step toward gaining more insight. Knowing where to look for underwriting guidance and what to expect on applications will better prepare you to navigate your clients through tricky health questions and parameters.

The What & Why of Underwriting

Underwriting is the process insurance companies use to establish an applicant’s health status and determine whether they want to accept the financial liability of insuring them. It involves a thorough investigation of health history on the application and during a follow-up phone interview with the applicant. If a company deems the applicant has too many costly health conditions, they have the right to deny coverage, restrict coverage, or raise premiums.

Insurance companies underwrite individuals to keep premiums and risks as low as possible and stay stable; however, restricting access to supplemental plans may mean that the people who need the supplemental coverage most aren’t getting it. Logically, the more people with expensive health problems a company accepts on a policy, the more the company will have to pay out for claims. The carrier would either charge higher premiums to make up the difference or not allow those people on the policy in the first place.

While the federal government standardizes Med Supp plan types and provides some protections to enrollees in the form of guaranteed issue (GI) rights (more below), they have no hand in regulating how insurance companies determine the underwriting process. Carriers don’t agree completely on what makes an applicant uninsurable, clouding who may qualify for certain Med Supps ever further.

When Underwriting Applies

Fortunately, your clients will have opportunities to enroll in a Med Supp without having to pass underwriting during certain periods when they have GI rights. During a GI period, insurance companies must:

Every individual aging into Medicare has a seven-month period to enroll in Original Medicare before incurring any penalties — their Initial Enrollment Period (IEP). Usually partly coinciding with their IEP is their Medigap Open Enrollment Period (OEP), when they have a GI right to enroll in a Med Supp policy. The OEP begins on the first day of the month an individual’s Medicare Part B is effective and they’re 65 or older. It lasts for six months, during which the individual can enroll in any Med Supp plan letter with any carrier, regardless of their health. Some carriers also allow submission of applications before the official start of OEP, usually up to six months before although sometimes as few as three. We recommend submitting Med Supp applications as early as possible to lock in a guaranteed rate and avoid any rate increases that may occur in the months leading up to a client’s OEP.

Outside of their OEP, individuals may have access to GI rights depending on the circumstance, usually if they qualify for a special enrollment period (SEP). While GI rights can vary from state to state, the federal government does require insurance companies to follow certain rules. Explore this table to see when your client might qualify for a GI policy.

Your Client Should Have a Federal Guaranteed Issue Right If…

They have an MA plan and… | Their plan is leaving Medicare or their service area Are moving out of their plan’s service area Are within their first year of enrolling in the plan, joined the plan when they became eligible for Part A at age 65, and want to switch Original Medicare Have been in the plan under one year, dropped a Med Supp plan to enroll in an MA plan for the first time, and want to switch back to Original Medicare Are leaving it due to being misled by the company or the company not following rules |

They currently have Original Medicare and… | Employee group or union (includes retiree and COBRA) coverage that pays following Medicare and that coverage is ending A Medicare SELECT plan and are leaving that plan’s service area Dropped a Med Supp plan to join a Medicare SELECT plan for the first time, have been in the plan under one year, and want to switch back to a Med Supp A Med Supp plan and the Med Supp carrier goes bankrupt and they lose coverage, OR their coverage ends due to reasons that aren’t their fault A Med Supp plan and are leaving it due to being misled by the company or the company not following rules |

They currently have Programs of All‑Inclusive Care for the Elderly (PACE) and… | Are within their first year of enrolling, joined the program when they became eligible for Medicare Part A at age 65, and want to switch to Original Medicare |

Note: The guaranteed issue rights in the table above are federal law. Certain states give residents additional Medicare Supplement rights.

Some states legislate more GI rights for consumers, with a small number of states allowing for continuous or annual GI periods (e.g., around a birthday). Familiarize yourself with the GI laws in your state to know whether your clients might benefit from expanded protections.

Your clients can change from one Med Supp policy to another any time of year, but they’ll have to be in good enough health to pass underwriting, unless they fall within their trial right or qualify for a GI right. To return from a Medicare Advantage (MA) plan to Original Medicare with a Med Supp, they’ll have to wait until the Medicare Annual Enrollment Period, from October 15 to December 7, and pass underwriting.

How Underwriting Impacts Enrollment Timeline

As a rule, when submitting Med Supp applications, always select an effective date of the first of the month, either the month your client turns 65 or, if they’re already 65, the next available first of the month. Since those turning 65 probably have a GI right, those in the latter group will be more likely to be subject to underwriting.

Underwriting takes time, so we suggest submitting applications two to three weeks out from the desired effective date to give the underwriter enough time to review the application and conduct a phone interview with the client. We’ve found that, on average, the underwriting process takes about seven to 10 days, but could be as quick as one day or as long as 30 days. If underwriting takes longer than expected and the pending application misses the first of the month effective date you’d applied for, the carrier will either backdate to the original effective date or automatically move it to the first of the next month. We recommend checking in with the carrier when this happens, in case you have a client who really needs the original effective date but the carrier is one that automatically pushes it to the next month.

Some companies have started using an auto-accept and decline feature in their online applications, but this is only for cut-and-dry cases without any ambiguity. In other words, an applicant would have to answer “no” to every health question and be in excellent health to receive an auto-acceptance. Any applicants whose answers result in a “maybe” will need a phone interview with an underwriter to determine the outcome.

How Underwriting Impacts Premiums

Many factors play into policy rates, and each carrier calculates premiums a little differently. Getting a grasp on general trends can be difficult.

All companies offer two types of rates for their Med Supps: preferred and standard. Preferred is the lower rate for non-tobacco users or for applicants who fall within certain height and weight categories, while standard is the slightly higher rate for tobacco users and those falling outside height and weight parameters. Keep in mind that the greater the liability a policyholder poses to the company, the more that holder will likely have to pay in premium. Carriers don’t want to accept too many applicants with an increased risk of health problems and, therefore, increased cost to insure.

It’s important to keep in mind, too, how carriers generally approach premiums when it comes to Med Supps so you can recommend policies that are not only financially attractive now but in 10 or 20 years, too. Most carriers increase the premium on the anniversary of the policy start date, and some carriers will additionally raise premiums on years when they adjust rates for the entire state. Some carriers cap premium increases at a certain age, like 85. If your 65-year-old client can barely afford the Med Supp you recommend, it’s likely they won’t be able to stay on the plan long-term as the premium steadily increases.

From there, premiums get more complex. The results of underwriting can increase premiums, depending on the carrier. Some companies adopt looser underwriting guidelines, accepting applicants with worse conditions while increasing the premium to compensate. Applicants with more health problems may be placed in another pricing tier called a “class” or “level.” Companies adopt this system in an attempt to strike a happy balance between controlling the inflation of premiums and allowing broad access to the policy. Of all the companies we work with, only a couple fully embrace this system, and we think it’s unlikely more will in the future due to the increased liability.

Other factors besides underwriting that could impact the premium are the type of policy, sex and geographical location of the applicant, method of payment, and company discounts. Types of policies not only include plan letter type (the better the coverage, the higher the premium), but also whether the policy is community-rated, issue-age rated, or attained-age rated. In community-rated, everyone pays the same for the policy. In issue-age rated, enrollees pay based on the age when they joined the policy. In attained-age rated, which is the most common (except in some states that require issue-age), enrollees pay more for their policy as they get older (and have an increased risk of health issues).

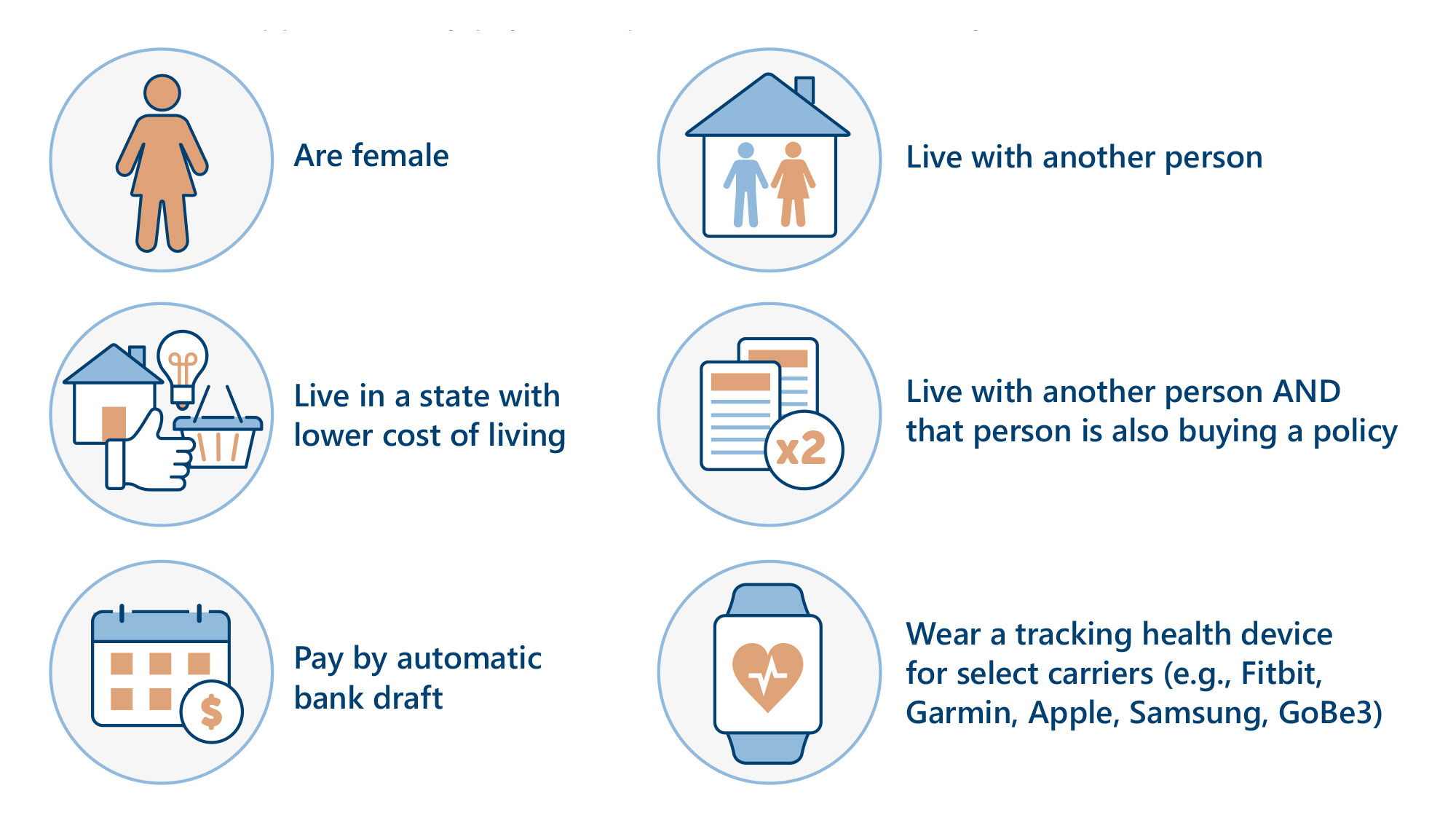

Other reasons applicants may pay lower premiums include if they:

Discounts like these can make affording a Med Supp more manageable.

Generally, when it comes to the question of underwriting impacting premium, if an applicant can pass underwriting, then they will pay the preferred or standard rate depending on tobacco usage. However, if applying to a company with looser underwriting guidelines, they may have to pay more depending on their class or level. Different types of discounts can lower the cost.

Learn More Inside A Comprehensive Guide to Medicare Supplement Underwriting!

Our Med Supp underwriting eBook is like a codebook to your business. Take the mystery out of Med Supp underwriting with our thorough exploration of all its facets, including why and when carriers underwrite, how underwriting impacts enrollment timeline, premiums, and commissions, how to utilize agent underwriting guidelines and Medicare Supplement applications, and more. Learn the top red-flag health issues to look for in your clients and the borderline conditions that will always have restrictions. With our tips and tricks, you’ll be able to more easily help your clients navigate underwriting and find the best possible plan for them.

BONUS: Enjoy two tear-out resources, a questionnaire for clients and a carrier comparison chart, to further simplify the process of underwriting!

Take a Peek Inside!

We sincerely hope this guide helps you easily understand the ins and outs of Medicare Supplement underwriting and accomplish your business goals! Fill out the form to get your free download today.

Results may vary based on individual user and are not guaranteed.